- Get link

- X

- Other Apps

If advance credit payments are made for you or an individual in your tax family for coverage in a year other than 2020 and you do not file a tax return you will not be eligible for advance credit payments in future years. Thats easy for people who get coverage through work or who can afford to pay big premiums for their own plan.

/obamacare-explained-1272f608281e4887969aa0a14b1bff1c.png) Obamacare Explained What You Need To Know Now

Obamacare Explained What You Need To Know Now

The Act granted a repayment holiday for 2020 which could lower what you have to repay in tax credits for the 2020 plan year.

Do you have to pay back affordable care act. With that said you may want to consult a tax professional for assistance and you would likely want to consult the marketplace. You cannot enroll in Obamacare. Its not an essential health benefit under the Affordable Care Act and is not.

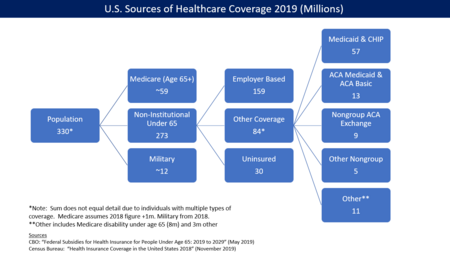

86 of ACA planholders in 2019 were eligible for an income-based discount called a subsidy. Under the Affordable Care Act ACA you must have a minimum level of health insurance coverage or pay a penalty unless you meet one of the exceptions. You will need to pay for long-term care if you become disabled or need to move to a nursing home.

The Patient Protection and Affordable Care Act ACA is federal legislation that was signed into law in 2010. With that said if you somehow took credits then had Medicaid start retroactively but made between 100 and 138 FPL there could be an odd case where you owed back some amount of credits up to the minimum limit. Households with a final income over 400 of FPL will be required to pay back the entire premium subsidy amount.

In some instances if your income ends up being lower than you project and you adjust your marketplace account you can get credit refund for cost-sharing charges already paid in a calendar. In case you missed the high points of the law heres a primer to help. If you dont pay back the amount due when you file your taxes the IRS will deduct it from your tax refund if any.

The American Rescue plan Act expanded cost assistance under the Affordable Care Act and made some changes that impact tax credit repayment limits. You calculate the amount you have to repay by completing IRS Form 8962 Premium Tax Credit. It also offers subsidies over.

How much they have to pay back will depend upon their final household income. This law commonly referred to as Obamacare made sweeping changes to how health insurance is procured and paid for. So generally the answer is no.

Its also not an issue for people who are already on Medicare or other government programs for health care. Youll be able to calculate this when you file form 8962. Opinions are strong about the Affordable Care Act but not everyone understands what the nearly 1000-page law does.

This means that you will not pay a penalty if you did not have health insurance in 2020. You are no longer required to report your health insurance on your return UNLESS you or a family member were enrolled in health insurance through the Marketplace and advance payments of the Premium Tax Credit were made to your insurance company to reduce your monthly premium payment. If the employer still disagrees with any proposed employer.

The Affordable Care Act is not a federal entitlement program like Medicare Medicaid or unemployment insurance. The IRS will acknowledge the employers response via Letter 227. In addition you may have to pay back some or all of the advance credit payments that are made on behalf of you.

Unlike Premium Tax credits you wont owe back any cost assistance you got on out-of-pocket costs via Cost Sharing Reduction subsidies. The Patient Protection and Affordable Care Act ACA of 2010 known as Obamacare imposed a lot of changes to the tax law. This cautionary tale has.

One of the weird quirks about Affordable Care Act health plans also called ACA or Obamacare is that most people dont pay the full sticker price. As you noted they wont make you pay back the tax credit that was paid on your behalf but there shouldnt be any excess amount. It is like this for any account which you have to pay taxes on when you withdraw funds.

It is not a single payer system that many of you have enjoyed while living abroad. For those households with incomes under 400 of FPL repayments will be capped at the following amounts. In 2019 the Tax Cuts and Jobs Act removed the penalty for not having insurance.

If you dont claim enough money to qualify for tax credits you wont owe back anything. Employers that do not provide Affordable Care Act-compliant health coverage are in danger of being assessed IRS penalties. One way to avoid having to pay back all or part of your Affordable Care Act premium assistance is to report to your health exchange any changes in your income during the year.

If you make less than 100 FPL you dont have to pay back the subsidies. But if you overestimate your income for Obamacare you may have to pay your government healthcare subsidy back. Do I have to Pay Back CSR Subsidies if my Income Changes.

This article provides a concise overview of Obamacare how it works and how it affects you. The ACAs premium tax credit is refundable ie theyll send you whatever excess amount youre owed even if you dont have to pay taxes but with an income of 700 your premium tax credit amount would have been reduced to 0 during the tax filing process. This means you will be responsible for the full cost of your monthly premiums.

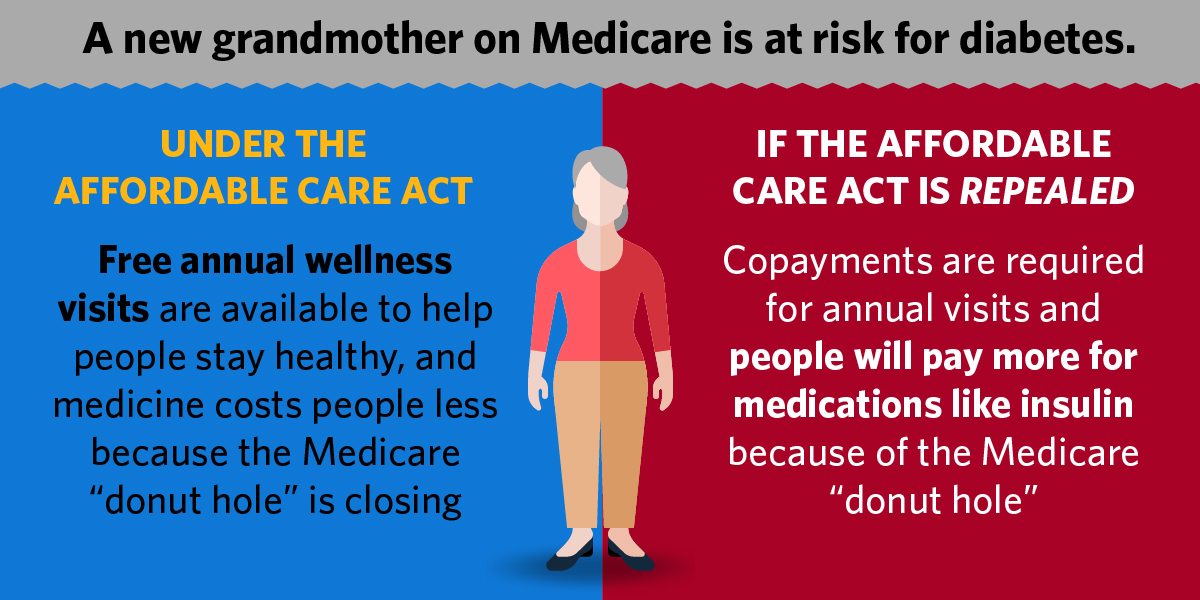

Heres a summary of the major taxes penalties fines and tax credits. Yes generally speaking taking a lump sum taxable payment affects ACA assistance. The Affordable Care Act also informally known as Obamacare is an attempt to reform the American healthcare system in order to expand coverage to millions of currently uninsured Americans and rein in the soaring cost of healthcare in the US.

Employers have 30 days to respond and can either pay the penalty or send the IRS an explanation of why it does not agree with the assessment.

/obamacare-taxes-penalties-and-credits-3306061_FINAL2-acbc62123f0a4d59860dd165ecc6aa8d.png) Will You Have To Pay Obamacare Taxes This Year

Will You Have To Pay Obamacare Taxes This Year

Tax Surprise Due To Covid 19 Part Of Aca Insurance Subsidy May Have To Be Paid Back

Tax Surprise Due To Covid 19 Part Of Aca Insurance Subsidy May Have To Be Paid Back

American Health Care Act Of 2017 Wikipedia

American Health Care Act Of 2017 Wikipedia

Making Health Insurance Cheaper For Millions Of Americans President Biden S Affordable Care Act Reforms Forbes Advisor

Making Health Insurance Cheaper For Millions Of Americans President Biden S Affordable Care Act Reforms Forbes Advisor

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

/obamacare-taxes-penalties-and-credits-3306061_FINAL2-acbc62123f0a4d59860dd165ecc6aa8d.png) Will You Have To Pay Obamacare Taxes This Year

Will You Have To Pay Obamacare Taxes This Year

An American Life With Or Without The Affordable Care Act Whitehouse Gov

An American Life With Or Without The Affordable Care Act Whitehouse Gov

Open Enrollment 2021 Guide Healthinsurance Org

Open Enrollment 2021 Guide Healthinsurance Org

/how-does-obamacare-work-3306053_V2-7ff9258589204402b95f58d4b48b14d5.png) How Does Obamacare Work For Me

How Does Obamacare Work For Me

Data Dive An Affordable Care Act Comeback On The Horizon

Data Dive An Affordable Care Act Comeback On The Horizon

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

/obamacare-pros-and-cons-3306059-final-HL-75d611454d684942a27cf4463e4841a6.png)

Comments

Post a Comment