- Get link

- X

- Other Apps

If you have additional money to set aside. How much starting principal do I need to meet my target income.

What Is An Annuity Guide To Annuities

What Is An Annuity Guide To Annuities

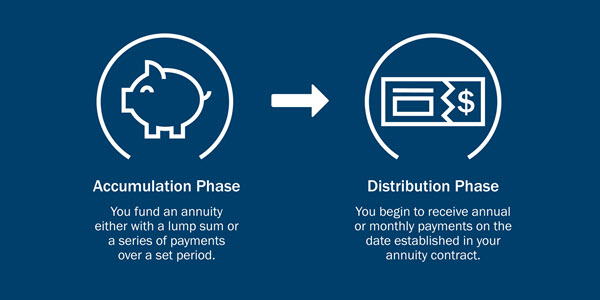

The true meaning of an annuity is a stream of regular payments made in exchange for an upfront premium.

Do i need an annuity. Its especially the case if you dont have another regular source of retirement income. An immediate annuity is a contract between you and an insurance company in which you are giving them a lump sum of assets and in return theyre giving you an income stream. Why buy an annuity.

This income stream can be set up to last for the rest of your life. Easily one of the most common questions we receive every year. An annuity is a way to supplement your income in retirement.

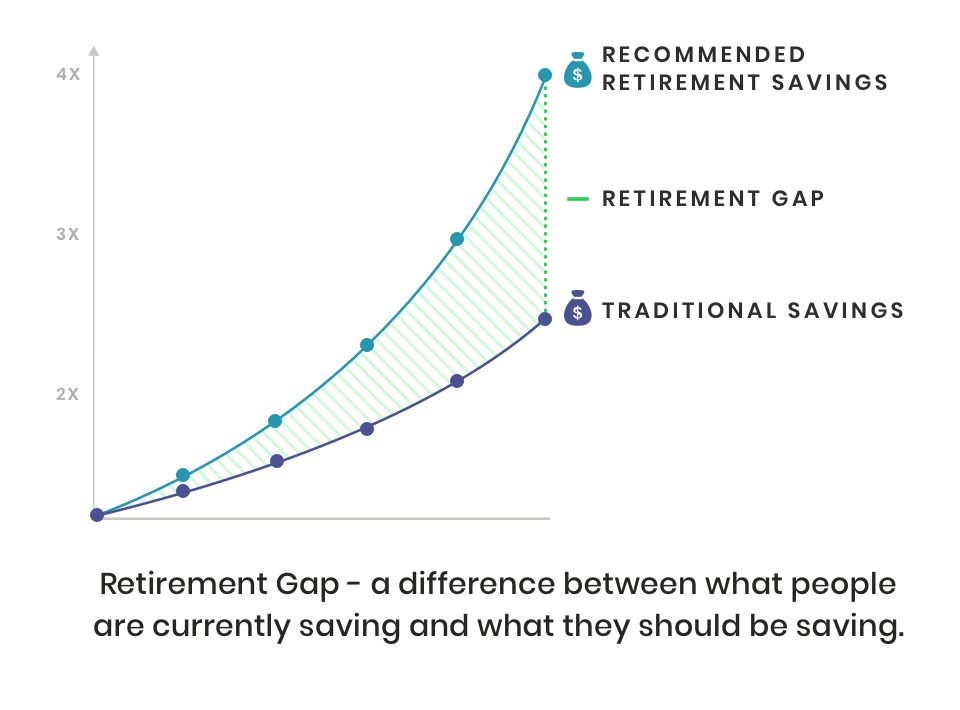

When first considering whether to buy an annuity it all comes down to the level of assets you have in relation to the amount of income you need each year in retirement. Protect against downturns and potentially grow your nest egg. How an annuity works.

Speak with a financial professional to figure out whether youll have enough money for your needs. The different types of annuities. A fixed annuity allows the money you have spent to grow on a tax-deferred basis.

Here are 15 things you need to know about annuities. Have a money question. For some people an annuity is a good option because it can provide regular payments tax benefits and a potential death benefit.

An annuity can provide guaranteed income that lasts for your lifetime -- no matter how long you live -- and can be a good way to supplement income. The insurance company guarantees that youll receive payments from the annuity at a fixed rate of return. If youve saved into a defined contribution pension scheme during your working life youll have to decide what to do with the pension fund youve built up when you approach retirement age.

Fixed Annuity Fees. What an annuity is. Annuities may have early withdrawal penalties.

An annuity can add to your other sources of retirement income and protect your assets from inflation and market volatility. Increase your buying power during retirement. The biggest of these is simply the cost of an annuity.

Receive predictable income for the rest of your life. Fixed annuities are also the least complicated type of annuity. Should I consider adding an annuity as part of my overall portfolio.

Having an annuity can make it easier to create a budget and manage your money. What growth rate do I need to meet my target income. Your advisor is likely taking this into account when saying you dont need an annuity.

An annuity running over 20 years with a starting principal of 25000000 and growth rate of 8 would pay approximately 209110 per month. One option is to buy a lifetime annuity often called just an annuity. Easily one of the most common questions we receive every year.

A variable annuity has investment risk. The amount of monthly lifetime payments is determined by your age at purchase and your life. Use a fixed annuity for principal protection.

However an annuity may not be the best option for you if your regular income and savings will already cover your expenses when you retire. However there are potential cons for you to keep in mind. This type of annuity is typically considered to carry the lowest risk since you know upfront how much interest your money will earn over time.

Annuities provide a fixed monthly income either for a set period of time or for the rest of your life. It can also be for both you and a spouse. Your annual spending must be relatively low so you can easily handle volatility in the years ahead without negatively affecting long-term performance.

Typically you should consider an annuity only after you have maxed out other tax-advantaged retirement investment vehicles such as 401 k plans and IRAs.

Do We Need An Annuity Jill On Money

Do We Need An Annuity Jill On Money

Why You Need To Include Annuities As Part Of Your Financial Planning

Why You Need To Include Annuities As Part Of Your Financial Planning

Find Out The 2 Questions You Need To Answer To Determine If You Need An Annuity Stan The Annuity Man

Find Out The 2 Questions You Need To Answer To Determine If You Need An Annuity Stan The Annuity Man

Is An Annuity Right For You Morningstar

Is An Annuity Right For You Morningstar

16 Things You Need To Know Now About Annuities Investing 101 Us News

16 Things You Need To Know Now About Annuities Investing 101 Us News

What Is An Annuity And How Does It Work Personal Capital

What Is An Annuity And How Does It Work Personal Capital

The Basic Principles Of Annuities Ameriprise Financial

The Basic Principles Of Annuities Ameriprise Financial

Annuity Definition Meaning Types Of Annuity Icici Prulife

Annuity Definition Meaning Types Of Annuity Icici Prulife

What Is An Annuity And How Does It Work Annuities Explained

What Is An Annuity And How Does It Work Annuities Explained

Find Out The 2 Questions You Need To Answer To Determine If You Need An Annuity Stan The Annuity Man

Find Out The 2 Questions You Need To Answer To Determine If You Need An Annuity Stan The Annuity Man

Why Buy An Annuity Top 4 Reasons To Purchase Annuities

Why Buy An Annuity Top 4 Reasons To Purchase Annuities

Annuity Vs Life Insurance Similar Contracts Different Goals

Annuity Vs Life Insurance Similar Contracts Different Goals

I Don T Have A Pension Do I Need An Annuity Annuity Guys

I Don T Have A Pension Do I Need An Annuity Annuity Guys

What Is An Annuity And How Does It Work Thestreet

What Is An Annuity And How Does It Work Thestreet

Comments

Post a Comment