- Get link

- X

- Other Apps

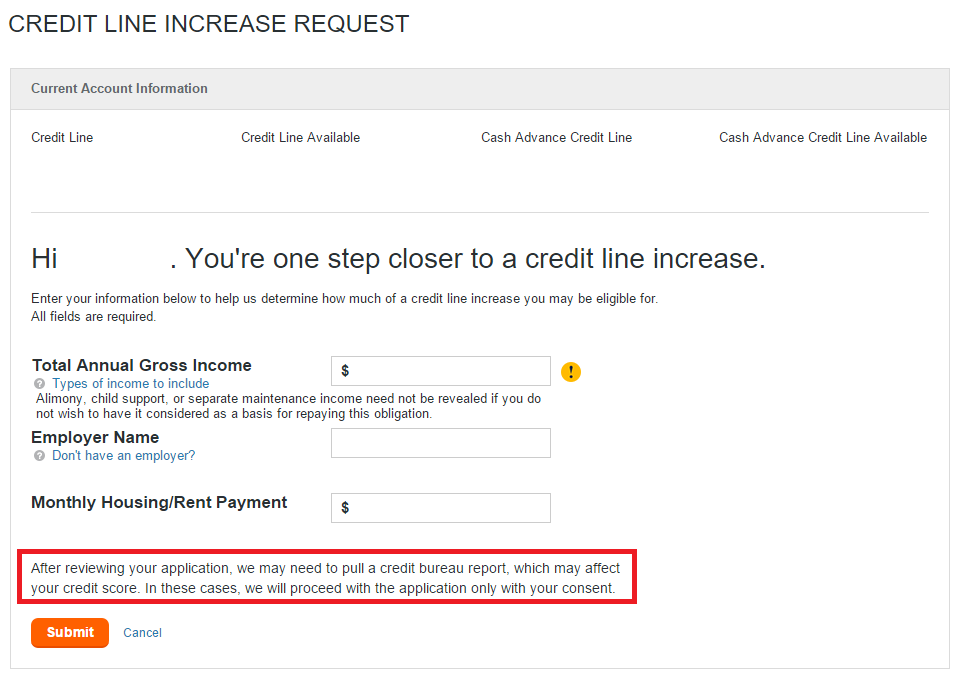

However several sources state that it reports your. After reviewing your application we may need to pull a credit bureau report which may affect your credit score.

Discover It Cli Disclaimer For Hard Pull Page 3 Myfico Forums 5465982

I did a 2500 secured card.

Discover it hard pull. I was pre-approved with a fixed APR etc. Started with a Transunion score of 586 and. Consider yourself very lucky for the limit - and if no HP ever.

Find out what credit bureau formally known as consumer reporting agencies Discover pulls for credit card applications. Ive made each payment on time. An example of a hard inquiry.

My EX score was 814. Its possible that Discover will pull your credit adding a hard inquiry to your credit report. My SL was 6K.

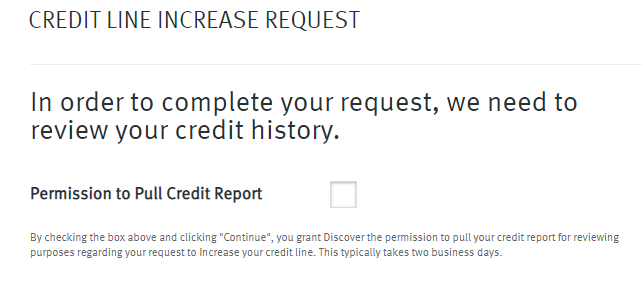

Its been 8 months. This is because Discover will not perform a hard pull when applying for pre-approval offers. What are soft pull credit.

Soft pull credit cards let you check for pre-approval and request a credit limit increase without a hard credit inquiry. When you first get a card your credit line also called a credit limit may not be as high as youd like. However some reports warn that if at any time you are asked for your full Social Security number rather than only the last four digits it may end up being be a hard pull.

A bank will make a soft inquiry about your credit history when for example it is deciding whether you are eligible to receive a pre-screened credit card offer. If youre trying to open several credit accounts in a short period of time like a credit card mortgage and a car loan you credit. Whenever opening a bank checking or savings account you can get either get a hard pull or a soft pull depending on the bank.

In general Discover does not reveal which credit bureaus receive its activity data. For the purposes of this post we only looked at data from 2014 onwards. You can read more about how credit inquiries affect your credit score.

With the exception of a handful of secured credit cards that dont check your credit at all when you apply you cant get a credit card without a hard inquiry. Having access to more credit can trigger overspending. Discover refunds deposits two ways.

This request is called a hard inquiry or hard pull But a hard inquiry is not the only kind of credit inquiry. How to pull up the offers Discover pre-approval tool The online Discover pre-approval page requires you to input more data than most pre. Enter in the credit limit increase you want and all other relevant information Discover will either give you the increase in which case only a soft pull is done or they will counter with another offer.

Heres how to get a Discover Secured Card credit limit increase. 1 automatic monthly reviews at 8 months to see if your account qualifies to graduate after showing responsible use of all your credit over time or 2 when you close your account and pay in full we will return the security deposit to you. No derogs on my credit report.

This type of inquiry will affect your credit score. Discover is one of the issuers that sometimes performs a soft pull while other times it performs a hard pull on your credit. One explanation may be that Discover pulls more frequently from Equifax implying that your Equifax FICO score may be slightly lower due to the impact of hard pulls.

You contact your credit card issuer and request a credit line increase. Requesting a credit limit increase with Discover is simple just make sure its the. That said once you formally apply for your pre-screened offer the hard inquiry will follow.

These inquiries stay on your credit report for two years and will temporarily knock a few points off of your credit score. Most soft pull credit cards do not however allow you to open a new account without a hard inquiry. You apply for a credit card it will pull a hard inquiry on your credit report.

In addition activity reported to just one or two bureaus can easily cause scores to vary. Too many hard inquiries on ones credit report can be resulted in. The company pulls your credit report to help evaluate the risk of approving your request.

In these cases we will proceed with the application only with your consent. Excellent card to help rebuild credit. However they generally wont affect your score for more than a year.

Deposit refunds can take up to two billing cycles plus ten days. The application form states. A higher credit line can have a positive impact on your financial situation by improving your credit and providing more borrowing power.

We are also only looking at cards issued by Discover. If youve had the card for a while and you want to make a large purchase that you could responsibly pay off or boost your credit score it may be a good time to request a credit line increase. For reference I got my Discover IT card 2 months ago and they did a hard pull on Experian.

According to reports accepting this offer should result in only a soft credit pull rather than a hard pull. If you reject their offer itll give you the option to request further review if you click this button a hard pull. Instead its more of a soft pull that wont bring down your credit score.

I think the only thing that impacted me - perhaps - was my combined revolving credit limits at the time of app were 17K. Hard pulls on the other hand are usually performed when you actually apply for credit and a lender approves or denies your application. Its important to find out if the bank will perform a hard credit check since a hard inquiry can negatively affect your credit score and may not be worth opening the checking or savings account.

Discover it cards average Overall Rating.

Which Credit Card Companies Do A Hard Pull For A Credit Limit Increase Doctor Of Credit

Which Credit Card Companies Do A Hard Pull For A Credit Limit Increase Doctor Of Credit

6 Best Discover Credit Cards 5 Cash Back 0 Fees More

6 Best Discover Credit Cards 5 Cash Back 0 Fees More

2 700 Discover It Secured Card Reviews Up To 2 Cash Back

2 700 Discover It Secured Card Reviews Up To 2 Cash Back

What Credit Card Do I Qualify For Discover

What Credit Card Do I Qualify For Discover

When Should You Request A Discover Credit Line Increase Discover

When Should You Request A Discover Credit Line Increase Discover

Which Credit Bureau Does Discover Use 2021

Which Credit Bureau Does Discover Use 2021

Which Credit Report Does Discover Pull Mybanktracker

Which Credit Report Does Discover Pull Mybanktracker

Discover Credit Line Increase Limit Cycling Policy

Discover Credit Line Increase Limit Cycling Policy

1 200 Discover It Cash Back Reviews Up To 5 Cash Back

1 200 Discover It Cash Back Reviews Up To 5 Cash Back

Does Applying For A Credit Card Hurt Your Credit Score Discover

Does Applying For A Credit Card Hurt Your Credit Score Discover

College Credit Card Discover It Student Chrome Discover

College Credit Card Discover It Student Chrome Discover

Discover It Cli Disclaimer For Hard Pull Page 3 Myfico Forums 5465982

Comments

Post a Comment