- Get link

- X

- Other Apps

Expat taxes are due May 17 2021 with an automatic extension to June 15 2021 The deadline to file your US. Make a Plan to Meet All Your Filing Requirements.

Common Us Expat Tax Forms For Americans Living Abroad

Common Us Expat Tax Forms For Americans Living Abroad

While this is only an approximate calculation it gives you an idea of how the system works.

Us expat taxes. Most Expats Dont End Up Owing US. June 15 US Tax Filing Deadline for Expats. Plus for an additional fee you can get support from a tax expert.

It offers three different tax software plans that are good for expatriates ranging from 2495 to 6495 for each federal tax return. US Tax Return Preparation for US expats and foreigners in USA - prepared in the USA. Do I have to pay taxes only on income from the US or also foreign income.

Net US tax payable 7204 - 5796 1408. Who is an Expat. Get Started Today with Experienced Staff for your Expat Tax Filing.

In order to not pay US. If you are a US. Behind on Your Expat.

The provisions contained in them in fact dont affect state tax return filing for expats at all. Next outline your other filing requirements so you can meet them. For a calendar year return the automatic 2-month extension is to June 15.

The only way is to expatriate basically giving up your US citizenship or green card. US tax on 114000 is 7204. First make a plan to file your US Federal Tax Return every year.

The leading and most affordable tax filing platform for American expats. Yes US citizens and green card holders are required to file and pay US taxes no matter where they live and work. Expat tax deadline to October 15.

The other method for reducing your US tax bill is the foreign tax credit using IRS Form 1116. Tax return is May 17 but US. It is available to US expats who have failed to report foreign financial assets and pay all the tax due as a result of the non-willful conduct.

No matter where you reside you must file US tax returns. Citizens abroad are granted an automatic extension to June 15 2021. Next Steps for Your US Expat Taxes 1.

First and most reliable. TFX helps non-US citizens or Green Card holders file returns. Get started call with tax preparer.

For 2021 the US tax filing deadline for expats to file is June 15. US Expat Tax Return. May 3 2021 Blog.

File a US Expat Tax Return Every Year. MyExpatTaxes is trusted by thousands of US expats every year. US Expatriate returns from 195 - Pay only after delivery to you and upon your satisfaction.

You can apply for a tax extension to extend your US. As an expat you may also have to pay taxes to the foreign country you live in. Note that you must pay any tax due by April 15 or interest will be charged starting from April 15.

Also if you live in Canada we can prepare your US and Canadian returns together. USA Expat Taxes has a team of experts specializing in Expat Taxes. Each Tax return is specifically tailored to limit our clients tax liability and maximize refund.

Get 100 tax compliant regardless of how complex your US expat tax situation is. In addition to our professional credentials we provide our clients personal communication and strive to keep the expat tax return filing as easy as possible. Is there any way to stop having to file US taxes.

US tax on 107600 amount excluded would be 5796. This deadline is a result of an automatic two-month extension that. American Expat Tax Services is an income tax preparation firm that specializes in all areas of US Income Tax Preparation Expat Tax Advice Compliance and IRS Problem Resolution for American Expats living or working outside of the United States.

A USA citizen or Green Card holder living abroad is an Expat. What is non-willful conduct. Expats also need to report the same foreign income in the US but it would be unfair if the same income is taxed by both the foreign country you live in as well as in the US.

The IRS defines this as conduct due to negligence inadvertence or mistake or conduct that is the result of a good faith misunderstanding of the requirements of the law. Our staff are highly trained tax professionals with decades of experience preparing returns for US Expats. Taxes Although all expats who earn over 10000 or just 400 of self-employment income are required to file a federal tax return the majority dont end up paying any US.

The US has international tax treaties with over 60 other countries however they dont prevent expats from having to file US federal or state tax returns. No matter where you reside you must file US tax returns. Youll get access to five of the most common tax forms that expatriates need Forms 1116 2555 8621 8833 and 8938.

US Expat Tax Software. Citizen or resident alien including a green card holder and you live in a foreign country mail your US. Taxes expats can claim some exemptions that the IRS has made available for them when they file.

25 Things You Need To Know About Us Expat Taxes

25 Things You Need To Know About Us Expat Taxes

Us Taxes As An Expat An Interview With Taxes For Expats Abroad American

Us Taxes As An Expat An Interview With Taxes For Expats Abroad American

American In The Philippines Here S The Expat Tax Information You Can T Afford To Miss Youtube

American In The Philippines Here S The Expat Tax Information You Can T Afford To Miss Youtube

Expatriates Object To Filing U S Taxes Accounting Today

Expatriates Object To Filing U S Taxes Accounting Today

Best Ways To Save Money On Us Expat Taxes Infographic

Best Ways To Save Money On Us Expat Taxes Infographic

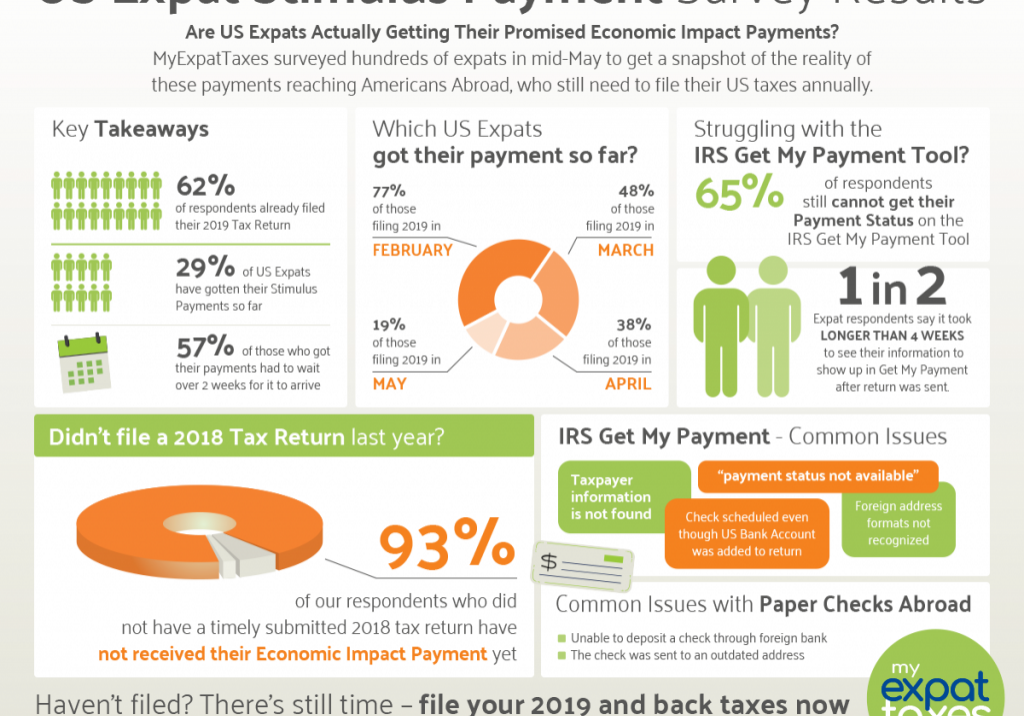

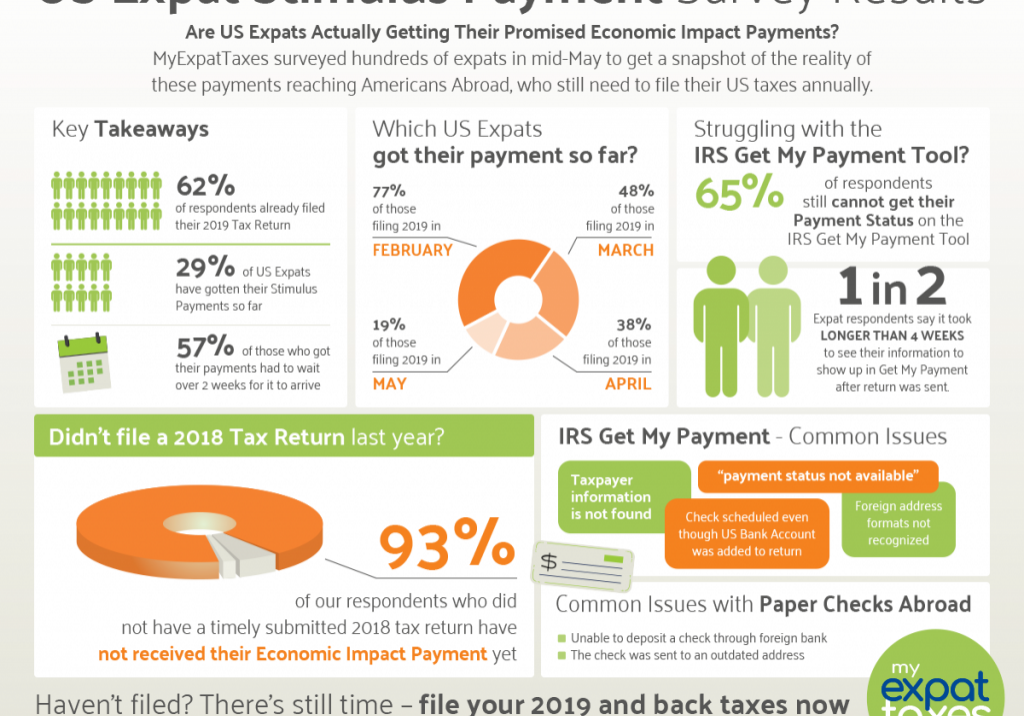

Us Expat Stimulus Check Survey Results Myexpattaxes

Us Expat Stimulus Check Survey Results Myexpattaxes

The Taxation System In The U S Tax In The Usa

The Taxation System In The U S Tax In The Usa

Usa Expat Taxes Usaexpattaxes Twitter

Usa Expat Taxes Usaexpattaxes Twitter

Do You Have To File U S Expat Tax Return As American Living Abroad

Do You Have To File U S Expat Tax Return As American Living Abroad

Completing Form 1040 With A Us Expat 1040 Example

Completing Form 1040 With A Us Expat 1040 Example

Why Americans Abroad Should File U S Tax Return

Why Americans Abroad Should File U S Tax Return

5 Things To Know About U S Expat Taxes Tax Return Infographics

5 Things To Know About U S Expat Taxes Tax Return Infographics

21 Things To Know About Us Expat Taxes In 2021 Myexpattaxes

21 Things To Know About Us Expat Taxes In 2021 Myexpattaxes

Comments

Post a Comment