- Get link

- X

- Other Apps

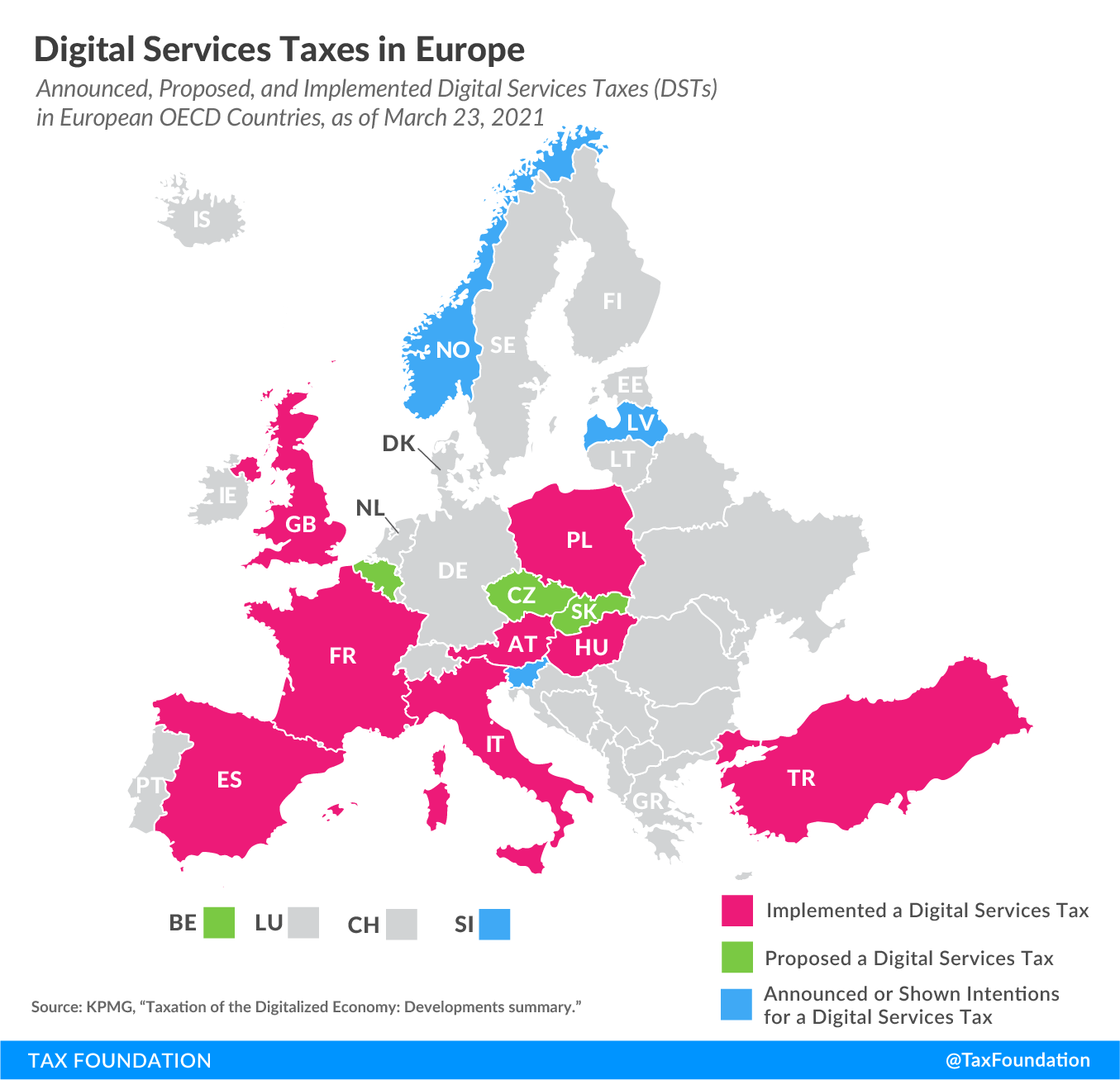

This updated Guide incorporated some of the recent changes to the Service Tax legislation effective 1 January 2021 as well as provides additional examples clarities. The UK is among the first to propose a tax on digital services while France is one of the first countries to implement legislation with retroactive effect.

Digital Tax Update Digital Services Taxes In Europe

Digital Tax Update Digital Services Taxes In Europe

It has proposed a digital services tax DST which would tax the part of a digital firms revenues attributed to European member states and a digital profits tax which would tax the slice of corporate profits derived in member states.

Digital service tax. 16 Zeilen About half of all European OECD countries have either announced. Digital Services Tax Who is likely to be affected. From 1 April 2020 the government will introduce a new 2 tax on the.

What is the Digital Service Tax. General description of the measure. Other countries have begun to follow Frances lead including Canada Italy and Turkey.

Each countrys proposed or implemented DST differs slightly. A DST is a tax on selected gross revenue streams of large digital companies. Digital Service Taxes or DSTs have been permeating the trade environment since 2018 but COVID-19 and the OECDs digitalization of the economy project commonly referred to as BEPS 20 have accelerated the focus on DSTs.

Thousands of businesses and individuals in the country are set for significant relief with Treasury pushing for amendments to excuse locals from accounting for the digital service tax. Whereas tax treaties and other agreements typically define a nexus and establish taxing rights between trading partners major European nations the European Commission and other world economies are asserting a novel. Austrias Digital Services Tax -.

VAT on digital services provided by foreign residents without permanent establishment The 2020 tax reform introduces new value added tax VAT rules for digital services provided through an online platform effective 1 June 2020. All DSTs have domestic and. Ziel der Maßnahmen ist es dass Unternehmen der Digital Economy wie zB Amazon Google Facebook Co mit ihren Gewinnen aus lokalen Tätigkeiten umfassender besteuert werden können.

For example France applies a 3 percent tax on revenues from targeted advertising the transmission of data collected about users for advertising purposes and from providing a digital interface. One of the biggest problems that have faced tax authorities is trying to tax companies that provide digital services while being physically located in other countries. What Is a Digital Service Tax.

Digital Services Taxes The notion of a digital services tax DST which would target search engines social media and online platforms took shape in 2017 out of consultations being held under the OECDs framework and was initially advocated by the UK. Status Update on Digital Services Tax Investigations of Brazil the Czech Republic the European Union and Indonesia - January 14 2021. Notice of Determination Pursuant to Section 301.

The Royal Malaysian Customs Department Customs has issued an updated Guide on Digital Services by Foreign Service Provider FSP as at 1 February 2021This Guide replaced the earlier version dated 1 August 2020. The Digital Service Tax being introduced by the UK government the EU and other countries worldwide is a tax that is applied to companies in the digital service industry. In the recently released Budget 2021 Canadas federal government announced its plan to continue with the development of a Digital Services Tax DST to.

And a few other countries. März 2018 hat die EU-Kommission ihren Fahrplan zur Besteuerung digitaler Unternehmen veröffentlicht Digital tax package. The 3 French tax targets internet and technology providers that have revenue in excess of 750 million globally and 25 million in France.

The stated aim of DSTs is to ensure that market countries get increased taxing rights over the profits of tech-based multinational companies that sell into their local. What is a digital services tax. In June 2020 ATAF released a policy document titled Domestic Resource Mobilisation Digital Services Taxation in Africa Policy Document which announced that ATAF is in the process of developing a Suggested Approach to Drafting Digital Services Tax Legislation Suggested Approach.

Report on United Kingdoms Digital Services Tax - January 14 2021. Digital service taxes DSTs are taxes imposed on multinational firms based on their digital activities in a particular jurisdiction. The newly introduced digital service taxDST could now only be payable by non-resident persons doing online sales to Kenyans if the finance.

Large multi-national enterprises with revenue derived from the provision of a social media.

Ksi Strategic Institute For Asia Pacific Where Leaders Meet

Ksi Strategic Institute For Asia Pacific Where Leaders Meet

Fair Taxation Of The Digital Economy Taxation And Customs Union

Fair Taxation Of The Digital Economy Taxation And Customs Union

The Uk S Digital Services Tax Where Are We Now Insights Jones Day

The Uk S Digital Services Tax Where Are We Now Insights Jones Day

The State Of The Nation The Digital Tax Conundrum The Edge Markets

The State Of The Nation The Digital Tax Conundrum The Edge Markets

Here S What You Need To Know About The Digital Tax In Malaysia

Here S What You Need To Know About The Digital Tax In Malaysia

Fair Taxation Of The Digital Economy Taxation And Customs Union

Fair Taxation Of The Digital Economy Taxation And Customs Union

Digital Service Tax Kra Lists Services That Attract The New 1 5 Levy Kenyan Wallstreet

Digital Service Tax Kra Lists Services That Attract The New 1 5 Levy Kenyan Wallstreet

Breaking Down France S Digital Tax Atlantic Council

Digital Tax Policies Analysis Of Digital Services Tax Proposals

Digital Tax Policies Analysis Of Digital Services Tax Proposals

Insight Uk Digital Services Tax What Does It Mean For Multinational Corporations

Insight Uk Digital Services Tax What Does It Mean For Multinational Corporations

Was Sie Uber Digital Service Tax In Kenia Wissen Mussen Victor Mochere

Was Sie Uber Digital Service Tax In Kenia Wissen Mussen Victor Mochere

New Digital Service Tax Levels Playing Ground The Standard

New Digital Service Tax Levels Playing Ground The Standard

Comments

Post a Comment