- Get link

- X

- Other Apps

Futures contracts without an expiry date. A futures contract is a financial product that derives its value from an underlying asset.

CME Group the worlds largest financial.

Bitcoin futures contract. The value of a Bitcoin futures contract is usually determined in BTC. We then explain how bitcoin futures differ from traditional futures contracts and how bitcoin futures allow investors to invest in BTC without the need to hold any of the digital asset. In brief A futures contract is an agreement that obligates a trader to buy or sell an asset at a specific time quantity and.

Bitcoin futures work the same way as any futures contract on a traditional financial asset. Sunday-Friday 6 pm-5 pm. However the Micro Bitcoins smaller contract size.

However there are also so-called perpetual contracts ie. This means that based on current prices of 18000-ish you would need to fork out 90000 per contract. It represents a legal agreement to buy or sell the underlying on a specified future date at an already agreed price.

Investors can either go long on Bitcoin expecting the price to increase or short it mitigating potential losses if they actually own some Bitcoin. BTCV2021 D BITCOIN FUTURES OCT 2021 2021-11-01. Many bitcoin futures contracts have an expiration date.

At 110 the size of one bitcoin Micro. 5 Zeilen Tap into the precision of a smaller-sized contract. Bitcoin futures help to bring in additional liquidity to the market and also provide opportunities for arbitrage.

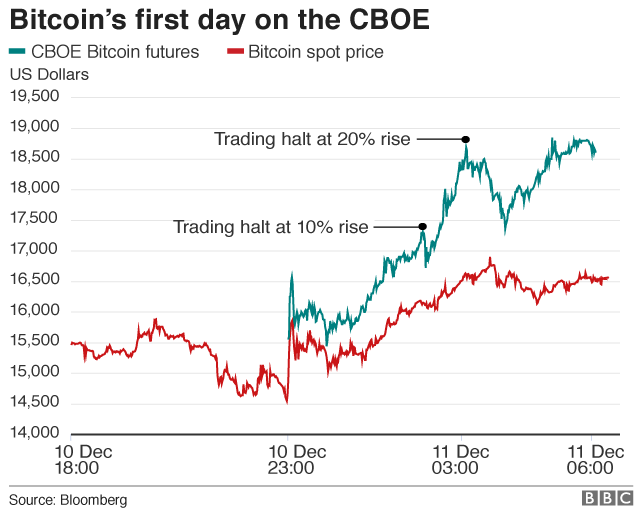

Bitcoin futures contracts were launched in December of 2017 and have already gained traction in the market. CMEs global head of equity index says that this new smaller contract along with the full-size bitcoin futures strengthens the exchanges ability to help a broad array of clients. Allgemein formuliert sind Bitcoin-Futures Handelsverträge zwischen zwei Parteien bei dem die Währung zu einem festen Preis und zu einem bestimmten Zeitpunkt in der Zukunft gekauft oder verkauft werden kann.

We explain what futures contracts are how they work and their intricacies with simple examples. These contracts are basically used to buy or sell bitcoin in the future at a fixed price in the present and therefore have a specific expiration date at which the settlement occurs. They are deemed as a good development for the crypto world as theyve introduced liquidity into the market and it allows investors to speculate on the future price of Bitcoin without actually owning any.

This acts as a means for businesses and industry to protect themselves from future price fluctuations but these contracts can also be traded by speculators. Below are the contract details for Bitcoin futures offered by CME. 5 Bitcoin as defined by the CME CF Bitcoin Reference Rate Price quotation.

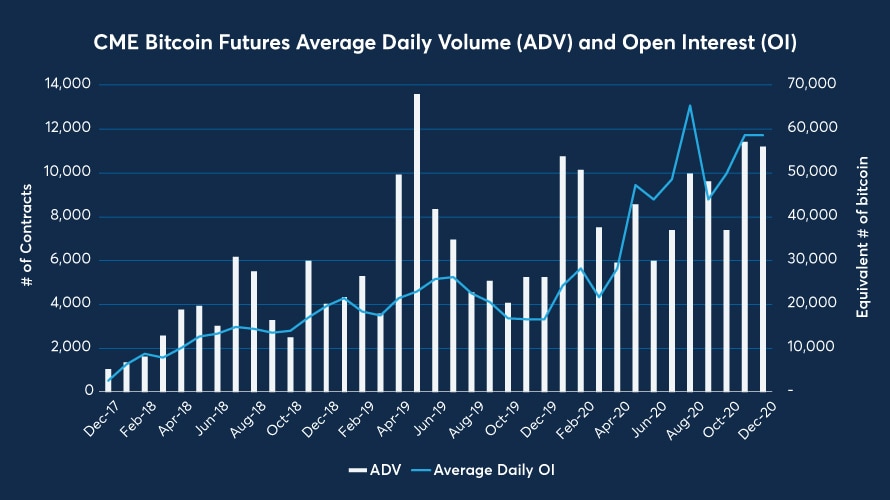

Bitcoin futures explained simply are a contract between two parties that agree to sell or buy Bitcoin on a set date for a set price in the future. Bitcoin Futures Explained in Simple Terms. More than 100000 micro bitcoin futures traded on CME in the first six days since launch the exchange has revealed.

Futures contracts are literally agreements to buy or sell an asset on a future date and for a fixed price. CMEs existing Bitcoin futures represent five Bitcoins per contract which at current Bitcoin prices represent a substantial upfront cost. Bitcoin futures is a futures contract where the involved asset is Bitcoin.

If an investor speculates that the price of Bitcoin will rise in future heshe enters into a futures contract to buy Bitcoin at a certain predetermined price with a Bitcoin seller. In the case of bitcoin futures the underlying asset is bitcoin. Many market participants who cannot hold spot positions in bitcoin cryptocurrency due.

As the trading value of Bitcoin varies so too will the. For example if you had access to the institutional Bitcoin futures market offered by CME each contract is worth 5 BTC. Contract Type Symbol Price Premium Volume Open Interest last index nom a USD USD Perpetual.

Cme Traded 2 Million Bitcoin Futures Contracts Since Launch

Cme Traded 2 Million Bitcoin Futures Contracts Since Launch

Bitcoin Futures An Introduction Sfox

Bitcoin Futures An Introduction Sfox

One Tenth Of A Bitcoin Derivatives Giant Cme Group To Launch Micro Btc Futures Contract Bitcoin News

One Tenth Of A Bitcoin Derivatives Giant Cme Group To Launch Micro Btc Futures Contract Bitcoin News

How Are Bitcoin Futures Priced

Bitcoin Futures Trading Begins On Cboe Exchange In Chicago Bbc News

Bitcoin Futures Trading Begins On Cboe Exchange In Chicago Bbc News

Bitcoin Futures Best Exchanges And How Trading Works Review Master The Crypto

Bitcoin Futures Best Exchanges And How Trading Works Review Master The Crypto

Trading Bitcoin Vs Btc Futures Which Is Best For You

Trading Bitcoin Vs Btc Futures Which Is Best For You

Cme Bitcoin Futures Price Above 20k In First Day Trading Coindesk

Cme Bitcoin Futures Price Above 20k In First Day Trading Coindesk

Bitcoin Futures Contract Specs Icon Alternatives

Demand For Btc Futures Seems To Increase As 2020 Progresses

Demand For Btc Futures Seems To Increase As 2020 Progresses

How Much Money Do You Need To Trade Bitcoin Futures Rcm Alternatives

How Much Money Do You Need To Trade Bitcoin Futures Rcm Alternatives

A Beginner S Guide To Bitcoin Futures Trading Itsblockchain

A Beginner S Guide To Bitcoin Futures Trading Itsblockchain

Comments

Post a Comment