- Get link

- X

- Other Apps

Platinum has taken a pause down 4 to 1192 and palladium is up 2 to 2721 amidst news that the. Precious metals are valued for as investments art jewelry and commodities.

An Investigation Of Trends In Precious Metal And Copper Content Of Ram Modules In Weee Implications For Long Term Recycling Potential Sciencedirect

An Investigation Of Trends In Precious Metal And Copper Content Of Ram Modules In Weee Implications For Long Term Recycling Potential Sciencedirect

In 2018 Silver prices are expected to settle at around 172 US.

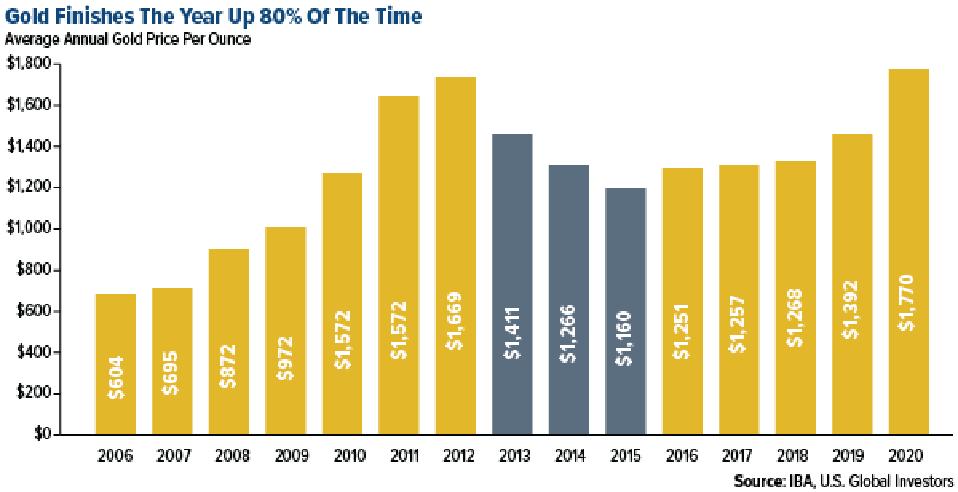

Precious metal trends. Gold prices silver prices platinum prices and much more. Interactive access to live precious metal prices and charts. The value of the materials is.

Precious metals are naturally occurring elements that are characterized by their high luster. The average price of one ounce of gold amounted to 3116563 manat which. According to Heit gold is expected to outperform other precious metals in the space due to higher demand.

Precious metals are naturally occurring metals that are relatively rare and difficult to find. A series of current and historical precious metals charts. They also usually have higher economic value.

Major Precious Metals beginnt mit der Mobilisierung für das Skaergaard-Bohrprogramm alle Unternehmensmitteilungen zu MAJOR PRECIOUS METALS onvista. Published by I. Rhodium output in South Africa is also expected to increase in 2020.

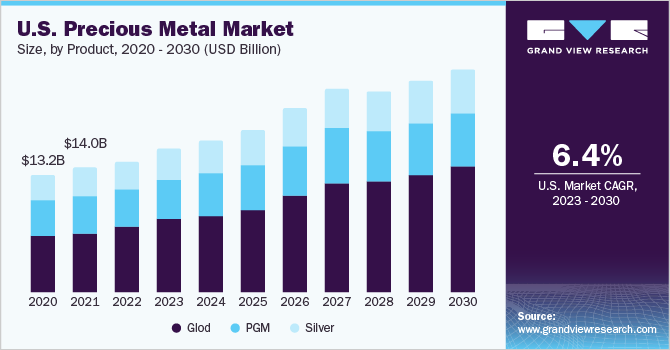

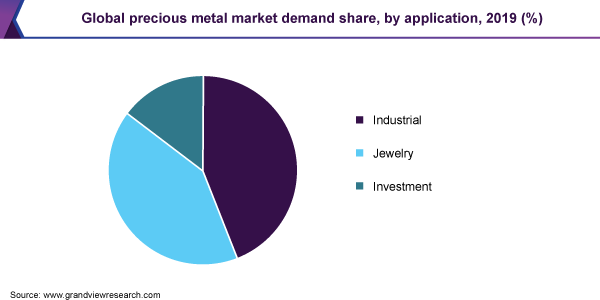

Claim Your FREE Silver Bar Discover How You Can Profit from the Greatest Wealth Transfer in History. The precious metals with active commodities markets include gold silver platinum and palladium. The global precious metal market size was valued at USD 1821 billion in 2019 and is expected to grow at a compound annual growth rate CAGR of 90 in terms of revenue from 2020 to 2027.

Metals that are rare high in demand and have high economic value are called precious metals. Major Precious Metals Corp. Take A Tour Discover The Worlds First Gold Silver Home Business Claim Your FREE Silver Bar.

We believe that precious metals are a long term investment recognizing any specific holding period may be affected by current market conditions requiring a longer or shorter holding period. The main precious metal utilized by speculators as a trading vehicle. Why Are Precious Metals Traded.

Precious metals Minor metals Designed to meet the needs of the minor metals communities participants can trade molybdenum and cobalt futures to transfer or take on risk against daily and transparent prices. Shifting the focus to silver Josip Heit expects its price to rally by 49 percent in the coming year which will see its price push closer to 19 per ounce with the growth rate for this year being predicted to be 31 percent. Precious metals are naturally occurring and rare metallic elements which tend to have lower reactivity and high lustre.

The price of gold is forecast to. They are also ductile malleable resistant to corrosion and good conductors of. These metals are rare hard less reactive and have high economic value compared to base metals.

Metals Minute Precious Metals Trends Gold and silver continued their upward trend from last week with gold up 610 to 1752 and silver up 2 to 2552. Includes inflation adjusted prices. Precious metals and rare coins can increase or decrease in value.

An ounce of gold in Azerbaijan rose by 2072 manat 07 percent during the past week. The production of the precious metal is estimated to witness a hike of 12 in North America and 1 in South Africa. The rarity of precious metals has traditionally given them a high economic value throughout history.

It is expected to remain the precious metal with the lowest value per ounce. The global precious metals market exhibited moderate growth during 2014-2019. Wagner May 7 2021 Precious metals such as gold silver and platinum are among the most valuable commodities worldwide.

Demand for the product in jewelry application is likely to emerge as an influential factor. The remaining PGMs rhodium ruthenium osmium and iridium have much smaller markets compared to the main four. Past performance is not a guarantee of future results.

Economic value of precious metals is driven by factors such as their rarity uses in industrial. Although manufacturers use the metal in some electronics. The global Precious Metals market was valued at USD 270140 million in 2019 and it is expected to reach USD 354480 million by the end of 2027 growing at a CAGR of 39 during 2021-2027.

Home Precious Metals Management

Home Precious Metals Management

Precious Metals Market Research And Analysis 2020 Trends Growth Opportunities And Forecasts To 2030

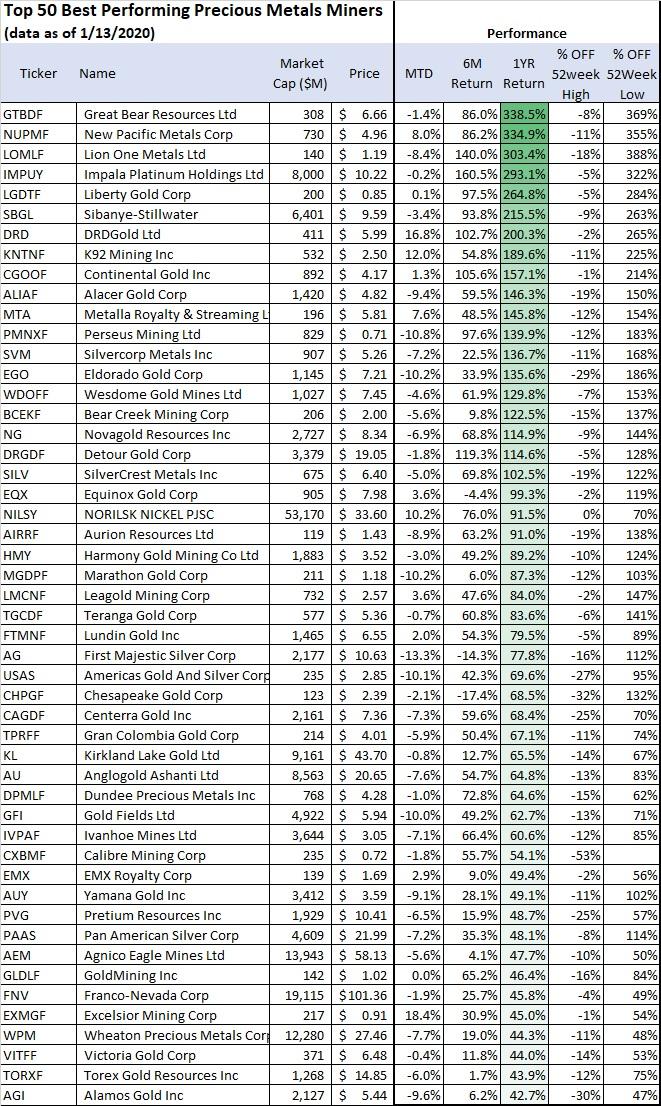

The Best Performing Gold And Precious Metal Miners January 2020 Seeking Alpha

The Best Performing Gold And Precious Metal Miners January 2020 Seeking Alpha

Precious Metals Weekly Jewellery Demand Outlook Insights

Precious Metals Weekly Jewellery Demand Outlook Insights

Precious Metals Etfs Slump As Investors Dump Gold And Silver

Precious Metals Etfs Slump As Investors Dump Gold And Silver

Precious Metal Market Size Trends Analysis Report 2020 2027

Precious Metal Market Size Trends Analysis Report 2020 2027

The Interesting Seasonal Trends Of Precious Metals Snbchf Com

The Interesting Seasonal Trends Of Precious Metals Snbchf Com

April Metal Price Trends Some Metal Rallies Starting To Wane

April Metal Price Trends Some Metal Rallies Starting To Wane

Metals At New Lows Precious Metals Up Investing Com

Metals At New Lows Precious Metals Up Investing Com

Precious Metals Outlook 2021 Renewable Energy Will Be A Key Driver

Precious Metals Outlook 2021 Renewable Energy Will Be A Key Driver

An Investigation Of Trends In Precious Metal And Copper Content Of Ram Modules In Weee Implications For Long Term Recycling Potential Sciencedirect

An Investigation Of Trends In Precious Metal And Copper Content Of Ram Modules In Weee Implications For Long Term Recycling Potential Sciencedirect

Precious Metal Market Size Trends Analysis Report 2020 2027

Precious Metal Market Size Trends Analysis Report 2020 2027

Precious Metal Consumption In Waste Mobile Phones Price Trends And Download Scientific Diagram

Precious Metal Consumption In Waste Mobile Phones Price Trends And Download Scientific Diagram

Precious Metal 3d Printing Expected To Drive 1 8 Billion Global Revenues 3d Printing Media Network The Pulse Of The Am Industry

Precious Metal 3d Printing Expected To Drive 1 8 Billion Global Revenues 3d Printing Media Network The Pulse Of The Am Industry

Comments

Post a Comment