- Get link

- X

- Other Apps

Total tax rate of profit. 71 rows 4 times more than Switzerland Total tax rate of commercial profits.

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Total tax rate of commercial profits.

Switzerland tax rate vs us. In Canada the differences are moderate as the highest taxes are only about one third higher than the lowest taxes. Tax bands are as follow. The tax rates displayed are marginal and do not account for deductions exemptions or rebates.

For instance for a net income of CHF 100000 the tax is 70 in Zug and 234 in. You can choose the preferred currency for the input amounts and displayed calculation. 18 more than United States 463 Ranked 63th.

Switzerland tax rates vs US tax rates. Switzerland as the residence country also subjects the US. This page provides - Switzerland Corporate Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

Foreign tax credit relief can be applied only on the US. Personal Income Tax Rate in Switzerland averaged 4009 percent from 2004 until 2020 reaching an all time high of 4040 percent in 2005 and a record low of 40 percent in 2008. Contact Us.

Below 37500 GBP - 20. This page provides - Switzerland Personal Income Tax Rate - actual values historical data forecast chart statistics economic. The federal Swiss corporate tax rate is a flat rate of 85 but additional cantonal and municipal rates can vary considerably.

The United States as the source country subjects up to 85 percent of the benefits paid to US. Taxable income CHF Tax. Above 150000 GBP - 45.

The Corporate Tax Rate in Switzerland stands at 18 percent. Mandatory social security contributions. Citizens residing in Switzerland to taxation.

In Switzerland these differences are more dramatic. Personal allowance is reduced by 1 GBP for every 2 GBP over 100000 GBP. Personal tax-free allowance provided of 12500 GBP.

Protocol Amending the Convention between the United States of America and the Swiss Confederation for the Avoidance of Double Taxation with Respect to Taxes on Income signed at Washington on October 2 1996 signed on September 23 2009 at Washington as corrected by an exchange of notes effected November 16 2010 and a related agreement effected by an. The maximum corporate tax rate including all federal cantonal and communal taxes is between 119 and 216. The Personal Income Tax Rate in Switzerland stands at 40 percent.

Corporate Tax Rate in Switzerland averaged 1944 percent from 2003 until 2020 reaching an all time high of 25 percent in 2003 and a record low of 1777 percent in 2017. With respect to dividends between qualifying related companies a mere notificationreporting procedure may be requested for the fraction of the Swiss WHT exceeding the residual WHT which is 0 in many cases. Moreover the tax rate depends on the province Canada or canton Switzerland of residence.

If you choose GBP as your preferred currency then the income entered will be converted to Switzerland. 12 more than United States 463 Ranked 58th. The statutory rate of Swiss WHT is 35.

1 JANUARY 1998 TABLE OF ARTICLES Article 1----- Personal Scope Article 2----- Taxes. 59 more than Switzerland Total tax rate of profit. However a range of allowances and deductions means youll usually pay much less.

Furthermore dividend income from substantial participations may be taxed at a lower tax rate based on domestic federal and cantonal law. DTTs the actual taxable income in Switzerland may differ from the tax rate determining income. 11 rows Switzerland has one of the lowest income taxes in the world charging a maximum.

A progressive tax system with 3 bands with tax rates from 20 to 45. Benefits received by those individuals to taxation. The table is not exhaustive in representing the true tax burden to either the corporation or the individual in the listed country.

Some other taxes for instance property tax substantial in many countries such as the United States and payroll tax are not shown here. Between 37500 GBP and 150000 GBP - 40. Personal income tax rates Direct federal tax on income for 2020 I - Single taxpayers.

Just like in Switzerland taxes in the United States are levied at both state and federal levels which sees large differences in income tax paid in different parts of the country. Relief if any is generally granted by refund. CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE SWISS CONFEDERATION FOR THE AVOIDANCE OF DOUBLE TAXATION WITH RESPECT TO TAXES ON INCOME SIGNED AT WASHINGTON OCTOBER 2 1996 TOGETHER WITH A PROTOCOL TO THE CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 29.

Federal income tax rates range between 10 per cent and 40 per cent and depending what state you live in you can pay an additional state income tax ranging. The effective rate is. Switzerland is a signatory to the Foreign Account Tax Compliance Act commonly known as FATCA which obligates Swiss banks to reveal information about US.

This calculator allows you to calculate income taxes and social contributions equivalent for Switzerland and United States and allow comparison between both.

Switzerland Will Remain A Low Tax Centre For Big Firms The Economist

Switzerland Will Remain A Low Tax Centre For Big Firms The Economist

What Are The Consequences Of The New Us International Tax System Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Swiss Corporate Tax Overhaul Faces Big Test Wsj

Swiss Corporate Tax Overhaul Faces Big Test Wsj

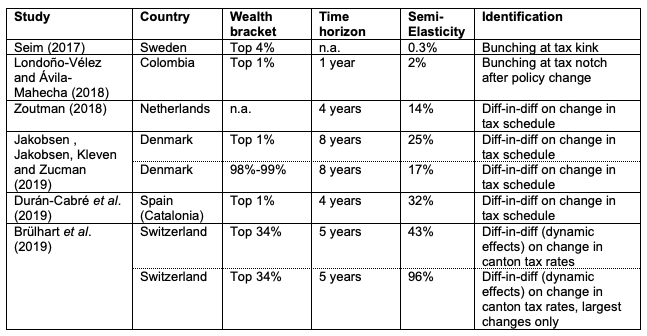

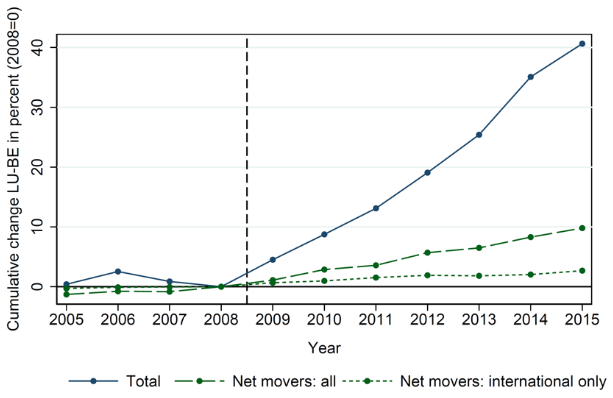

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

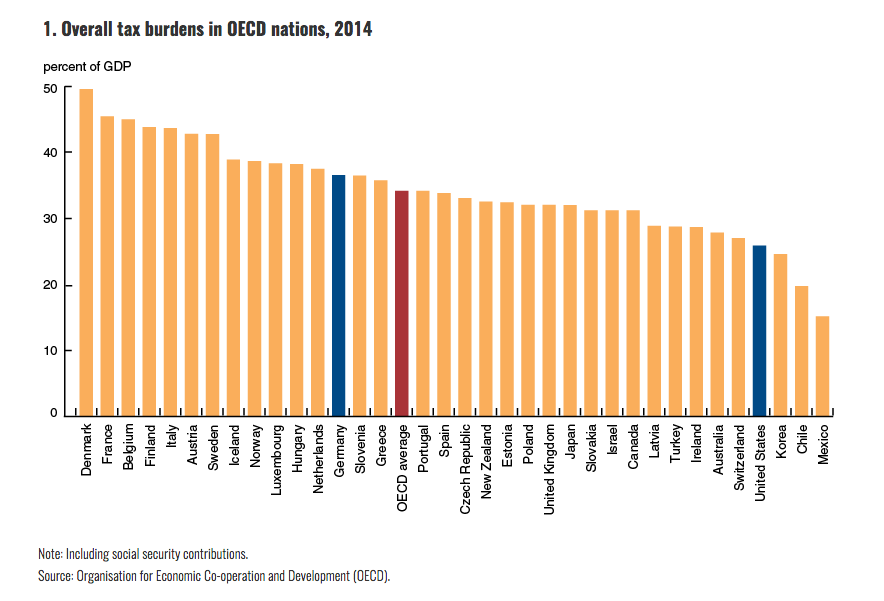

How Low Are U S Taxes Compared To Other Countries The Atlantic

How Low Are U S Taxes Compared To Other Countries The Atlantic

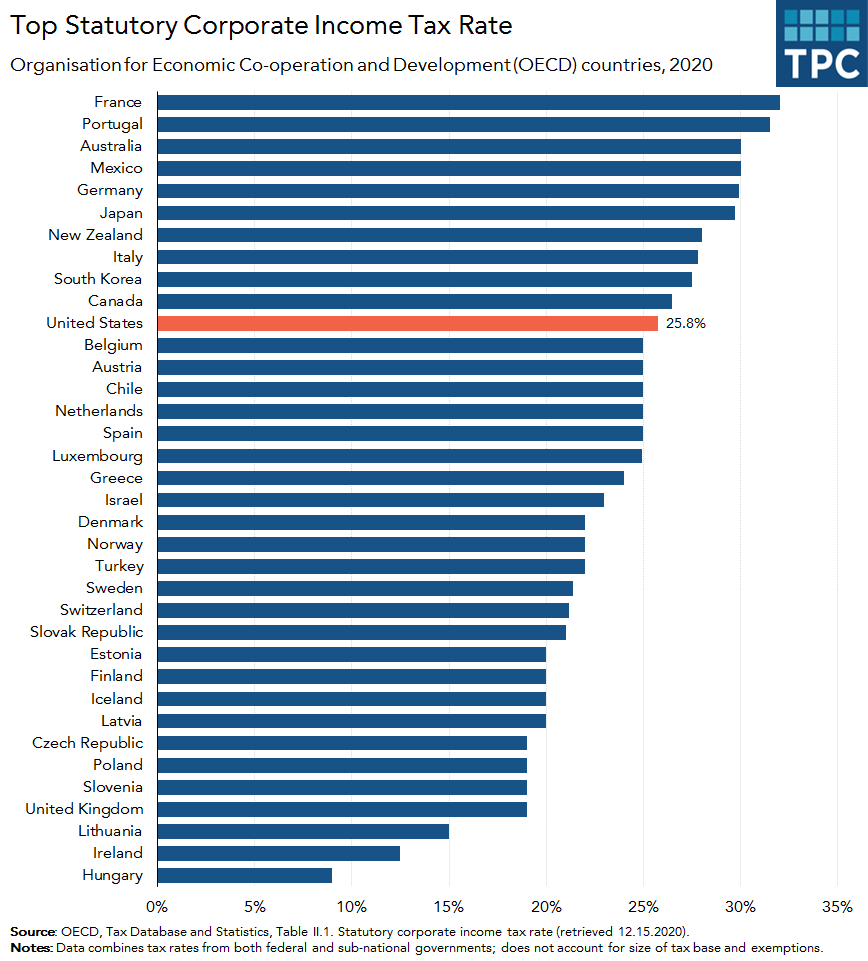

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

Yes The U S Corporate Tax Rate Is High National Review

Yes The U S Corporate Tax Rate Is High National Review

Taxation In Switzerland Wikipedia

Taxation In Switzerland Wikipedia

How Scandinavian Countries Pay For Their Government Spending

How Scandinavian Countries Pay For Their Government Spending

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Oecd Corporate Tax Rate Ff 01 04 2021 Tax Policy Center

Oecd Corporate Tax Rate Ff 01 04 2021 Tax Policy Center

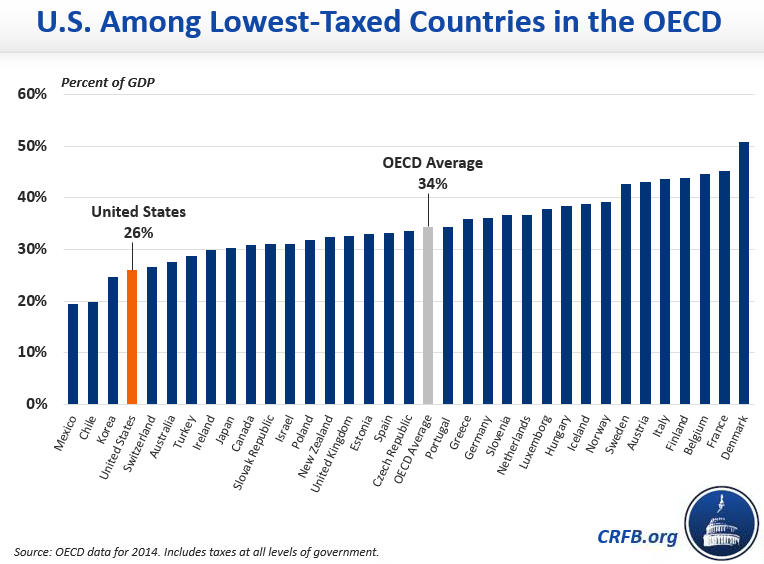

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

The U S Corporate Effective Tax Rate Myth And The Fact Tax Foundation

The U S Corporate Effective Tax Rate Myth And The Fact Tax Foundation

Comments

Post a Comment